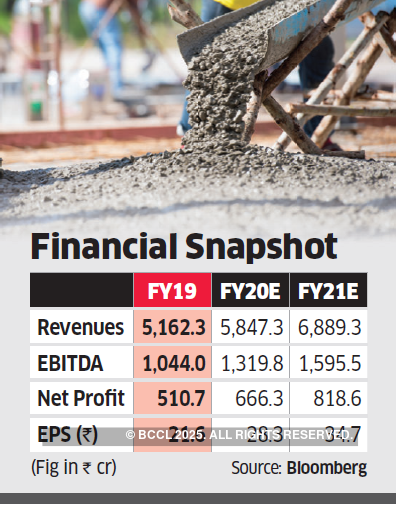

The Ramco Cements could surprise the Street on earnings per share (EPS) gains, and odds are shortening on the mid-sized cement maker beating estimates of linear profit growth.

At the vanguard of that effort is cost control when growth, particularly in peninsular India, was rather uneven. This provided an edge relative to peers. Ramco was circumspect with capacity expansion and instead focused on improving cash-flows.

As a result, Ramco’s debt to EBITDA (operating profit before tax) ratio fell from its peak range of 3-5 to 1.5 in FY19. By implementing this strategy, the company has achieved capacity utilisation of 90 per cent in FY19 on integrated capacity. This is higher than the industry’s capacity utilisation of 67 per cent.

At such elevated utilisation level and well-managed balance sheet, Ramco is now seeking to add capacity by 45 per cent to 20 million tonnes in the next two years.

On enhanced capacity, Ramco Cements is expected to see volume growth in the range of 8-15 per cent for the next two years.

This growth range would be little lower than that for sector leader UltraTech Cement.

With increasing expectations of stable demand growth of 5-6 per cent in the second half of the present fiscal, Ramco’s enhanced capacity should boost its earnings from selling per tonne of cement.

Ramco Cement is expected to benefit from stable demand in the eastern region, which would offset any volatility in demand in the southern markets.

In FY18, the company generated EBITDA per tonne of Rs 1,129, which fell to Rs 921 in FY19.