The COVID-19 era presents a radically transformed real estate market, with preferences changing to accommodate new market realities. With work-from-home a viable option even after the lockdown, many future homebuyers will shift to the peripheral areas for bigger homes and a better lifestyle – at more affordable prices.

The previous ‘gold standard’ of Indian housing – the walk-to-work / short drive to work, by definition only in and around central corporate workplace hubs – may shed some its popularity for the middle class. Central locations would retain their allure for HNI / C-suite buyers who can afford larger spaces there.

“The work-from-home concept may become the next fulcrum for homebuying decisions, where the walk-to-work option had held the longest sway,” says Anuj Puri, Chairman – ANAROCK Property Consultants. “This, and millennials’ new-found preference for buying rather than renting homes, are among the most prominent new residential real estate trends of the COVID-19 era. With the rise of the WFH culture, many may now prefer to live in more spacious and cost-effective homes in less central areas. While sufficient supply currently exists in most of the peripheries, this new demand will eventually also dictate fresh supply. Bigger homes, affordable prices and more generous open spaces in the peripheral areas will draw demand from tenants and buyers alike.”

- With the rise of work-from-home (WFH), prospective homebuyers will see sense in shifting to city peripheries; the ‘walk-to-work’ concept may lose some sheen

- Bigger homes, affordable prices & more open spaces in peripheral areas a distinct value proposition for homebuyers

- Avg. price of standard 1,000 sq. ft. home in MMR is 70% higher in city limits than in peripheral areas; NCR – 57%, Bengaluru – 38%

- Avg. rentals differ similarly; total 5-year rental outgo in city limits equals 27%-52% of total property cost in peripheries of these top 3 cities

- Ongoing & planned infrastructure will boost connectivity of peripherals with city centres

Central vs Peripheral Areas: The Price Difference

Apart from changing real estate consumer preferences in a strengthening WFH environment, affordability is an enduring concern especially to the backdrop of a faltering economy and job loss/uncertainty. The peripheral areas are more affordable both from a rental and purchase perspective. ANAROCK has analysed the cost difference for India’s three largest economic dynamos – MMR, NCR and Bengaluru.

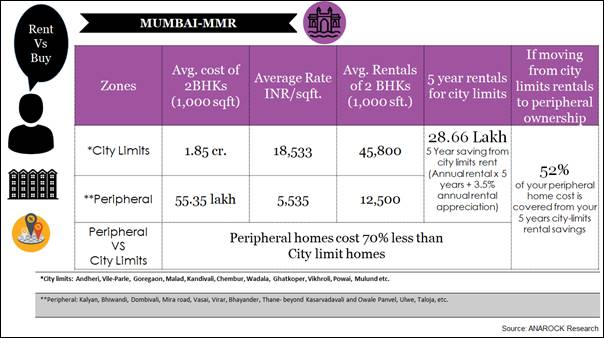

MMR (Mumbai Metropolitan Region)

- In MMR, the average price for a standard 1,000 sq. ft. property in areas within city limits is approx. INR 1.85 crore, against INR 55.35 lakh in the peripheral areas – a 70% cost difference. Micro-markets within city limits considered include Andheri, Vile Parle, Goregaon, Malad, Kandivali, Chembur, Wadala, Ghatkopar, Vikhroli, Powai, Mulund, etc. Peripheral areas include Kalyan, Bhiwandi, Dombivli, Mira Road, Vasai, Virar, Thane beyond Kasarvadavali and Owale Panvel, Ulwe, Taloja, etc.

- Avg. monthly rent for a standard 2BHK home in areas within city limits is approx. INR 45,800, against INR 12,500 in the peripheries.

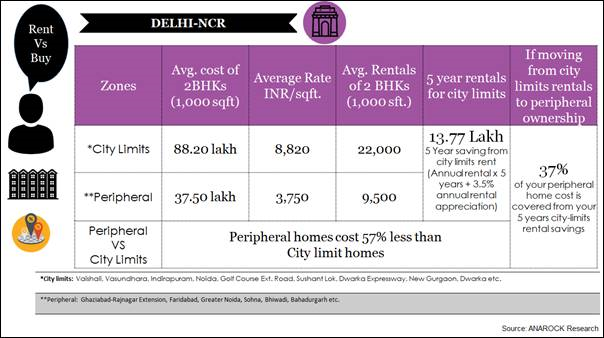

NCR (National Capital Region)

- In NCR, the average price for a standard 1,000 sq. ft. property in areas within city limits is approx. INR 88.20 lakh, against INR 37.50 lakh in the peripheral areas – a 57% cost difference. Micro-markets within city limits considered include Vaishali, Vasundhara, Indirapuram, Noida, Golf Course Ext. Road, Sushant Lok, Dwarka Expressway, New Gurgaon, Dwarka, etc. Peripheral areas include Ghaziabad-Rajnagar Extension, Faridabad, Greater Noida, Sohna, Bhiwadi, Bahadurgarh, etc.

- Avg. monthly rent for a standard 2BHK home in areas within city limits is approx. INR 22,000, against INR 9,500 in the peripheries.

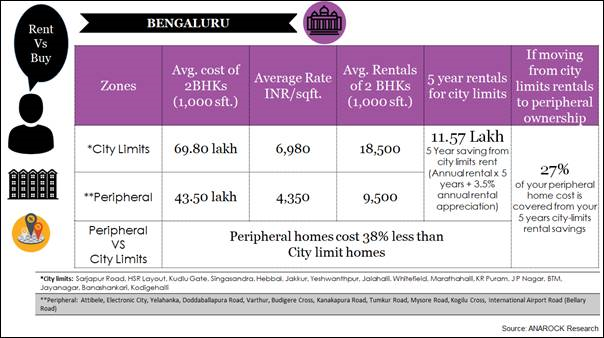

Bengaluru

- In Bengaluru, the average price for a standard 1,000 sq. ft. property in areas within city limits is approx. INR 69.80 lakh, against INR 43.50 lakh in the peripheral areas – a 38% cost difference. Micro-markets within city limits considered include Sarjapur Road, HSR Layout, Kudlu Gate, Singasandra, Hebbal, Jakkur, Yeswanthpur, Jalahalli, Whitefield, Marathahalli, KR Puram, J P Nagar, BTM, Jayanagar, Banashankari, Kodigehalli, etc. Peripheral areas include Attibele, Electronic City, Yelahanka, Doddaballapura Road, Varthur, Budigere Cross, Kanakapura Road, Tumkur Road, Mysore Road, Kogilu Cross and International Airport Road (Bellary Road).

- Avg. monthly rental for a standard 2BHK home in areas within city limits is approx. INR 18,500, against INR 9,500 in the peripheries.

Rent vs Buy: What the Data Says

The rent vs. buy debate involves multiple highly subjective factors. However, since millennials are increasingly interested in homeownership post-COVID-19, it is worth calculating what works better for most in the current circumstances.

ANAROCK data reveals that the 5-year rental outgo for tenants living within city limits is equivalent to 27-52% of the total property cost in the peripheries of the top 3 cities (MMR, NCR and Bengaluru). Therefore, there is a strong rationale for homeownership in the peripheries. We have considered the total annual rental outgo for 5 years + 3.5% annual rental appreciation.

Also, the current home loan interest rates are at an all-time low, averaging around 7.15-7.8% – with the possibility of more reduction as the RBI recently cut repo rates even further.

- In MMR, the average monthly rental outgo in city-limit areas is INR 45,800. For five years, this equals nearly INR 28.66 lakh (including standard rental escalation for this period). This is almost 52% of the total average cost of a property in MMR’s peripheral areas.

- In NCR, the average monthly rental outgo in city-limit areas is INR 22,000. For five years, this equals nearly INR 13.77 lakh (including standard rental escalation for this period). This is almost 37% of the total average cost of a property in NCR’s peripheral areas.

- In Bengaluru, the average monthly rental outgo in city-limit areas is INR 18,500. For five years, this equals nearly INR 11.57 lakh (including standard rental escalation for this period). This is almost 27% of the total average cost of a property in the peripheral areas.